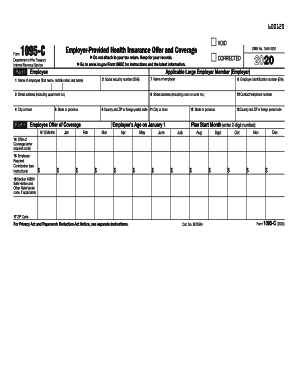

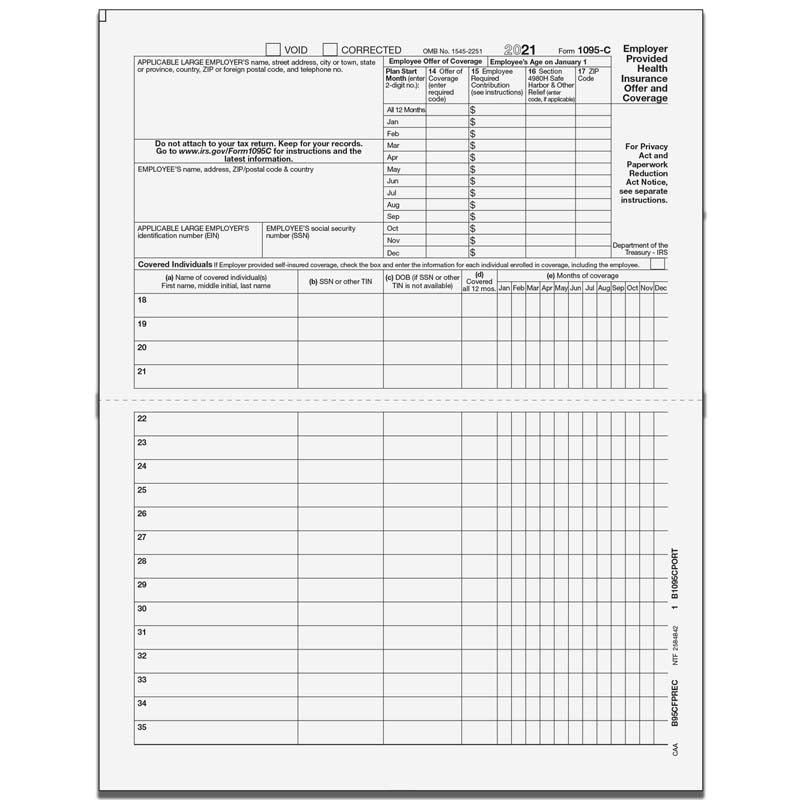

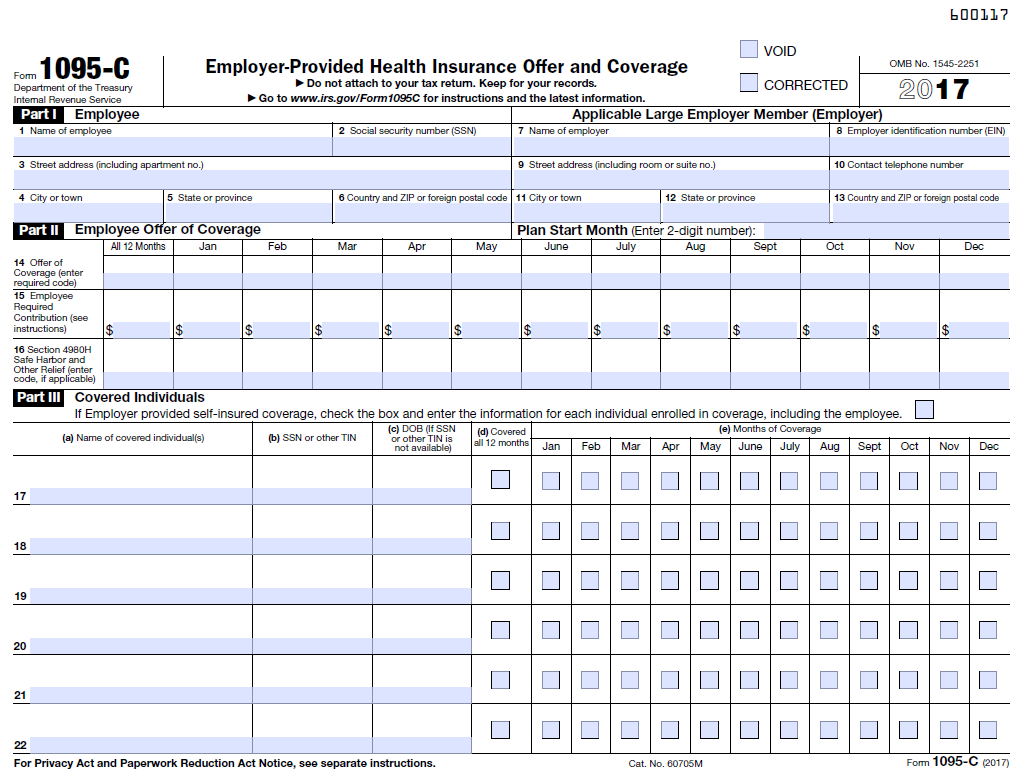

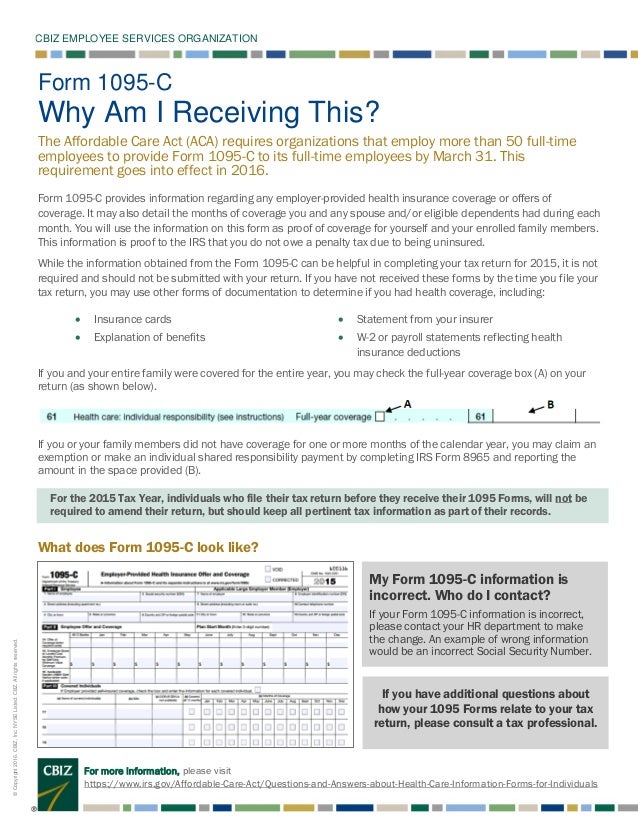

Information on the 1095C Every employee of an ALE who is eligible for insurance coverage should receive a 1095C Eligible employees who decline to participate in their employer's health plan will still receive a 1095C The form identifies The employee and the employer;The form 1095C for 21 is a form that is used to report information about the health coverage that an individual has In order to receive 1095 C Tax form credits or subsidies, the individual must have coverage that meets the minimum standards set by the Affordable Care Act Form 1095C is usually filed by the individual's employer The IRS recently released the final instructions to the Forms 1094C and 1095C with minimal changes compared to the final instructions from 17 Most of the changes made compared to previous iterations were so minor they are not even worth mentioning, but somewhat baffling and lacking grammatical support, such as putting Arabic numbers like "4" instead of

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1095 c form instructions pdf

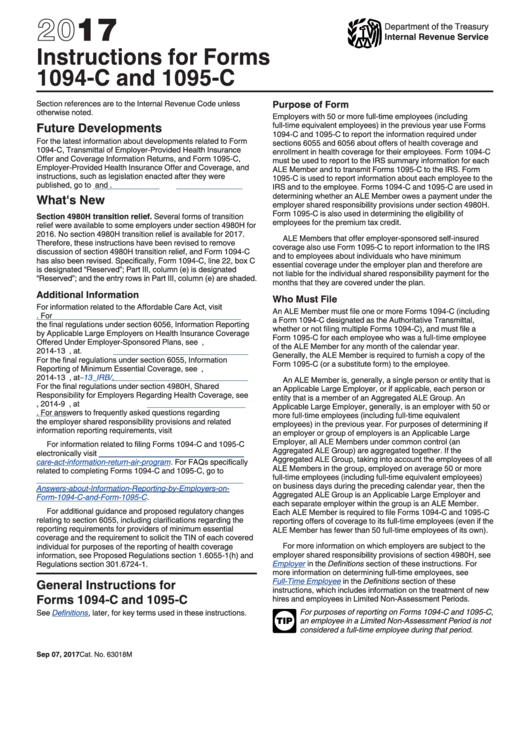

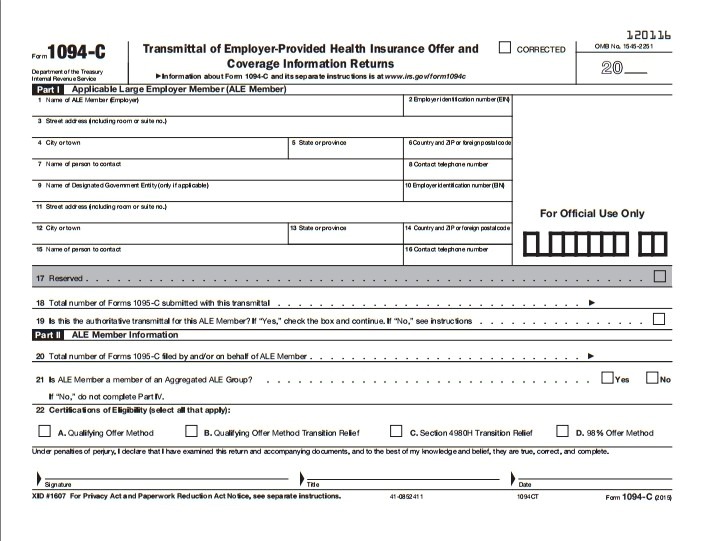

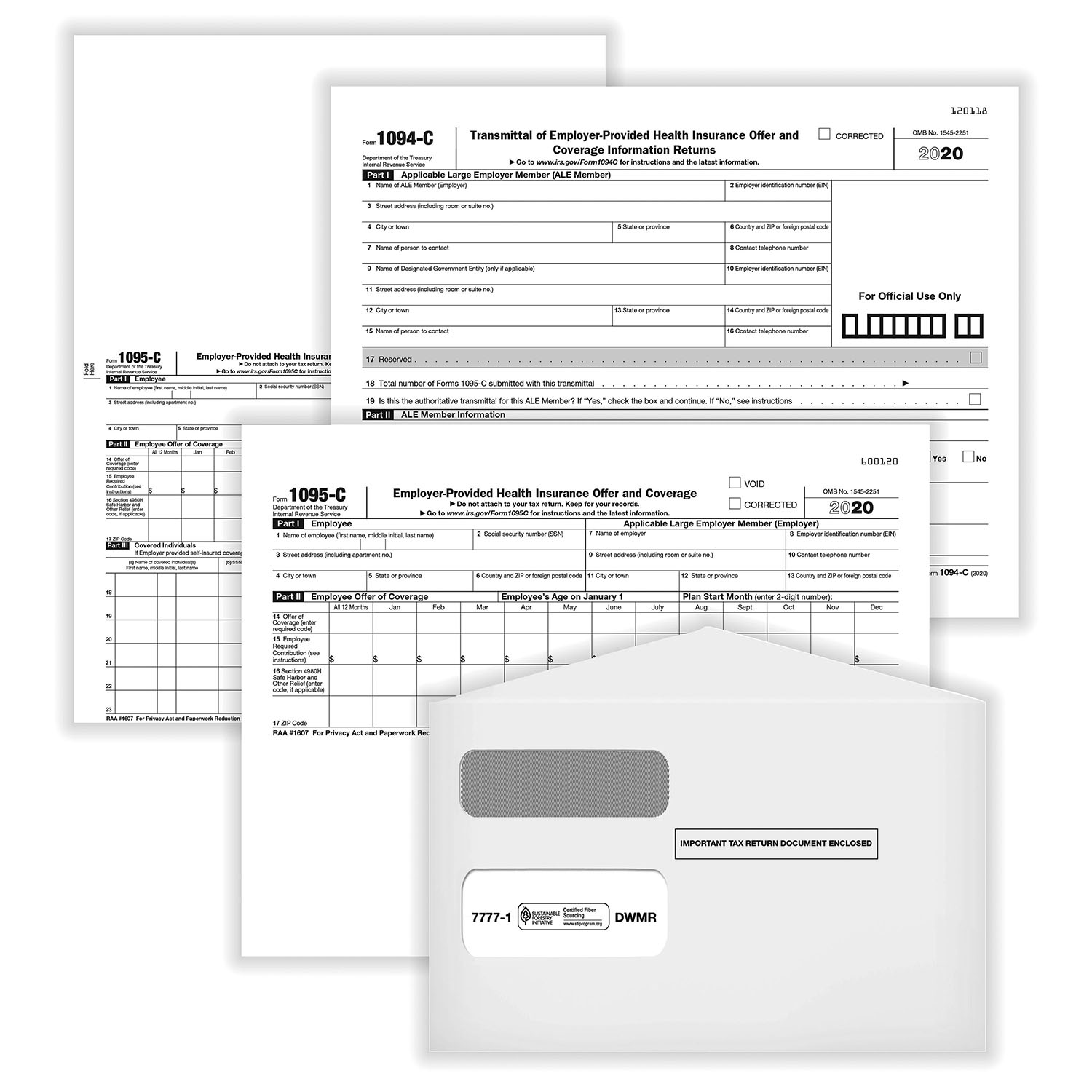

1095 c form instructions pdf- The IRS requires any ALEs to mail the ACA 1095C forms to employees by January 31st and efile the 1095C forms, along with the 1094C Transmittal form, with the IRS by March 31st If the deadline date falls on a Saturday, Sunday orForm 1095C is a tax document that is used to verify coverage information to employers and other entities It is also used to assess a penalty if the individual is uncovered Form 1095C is a form for those who have purchased a Marketplace insurance plan This form is used to determine whether or not an individual had a penalty for not having health insurance coverage

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

File a Form 1094C (do not mark the "CORRECTED" checkbox on Form 1094C) with corrected Form(s) 1095C Furnish the employee a copy of the corrected Form 1095C, unless the ALE Member was and continues to be eligible for and used the alternative method of furnishing under the Qualifying Offer Method for that employee for that year's furnishingACA 1095C form Data from this file is used to populate both the print forms provided to the emp loyee and data filed with the IRS Th is section will give you an overview of Column mapping from the provided Agency File to the 1095 form Also, for each mapped section , these instructions will indicate what is required IRS ISSUES ACA 18 FORMS 1094C AND 1095C, INSTRUCTIONS, AND 226J FOR 16 Robert Sheen ACA Reporting, Affordable Care Act 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link

Download a free trial of our 1095 Mate® 21 ACA 1095 Software Supported Platforms Windows 10, 81, 8, 7, Vista, XP and Server 03 File Details File Name MateTrial1exe Product Name 1095 Mate® File Size 232 MB Date Published Version 702 Product brief description Affordable Care Act forms 1094C / 1095C printing andFor more detailed instructions on Form 1095C, visit the IRS instructions page When should I expect to receive my Form 1095C from my employer?Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage

A similar reference suggests finalization of Pub 5223, "General Rules and Specifications for Affordable Care Act Substitute Forms 1095A, 1094B, 1095B, 1094C, and 1095C," but the IRS web Forms 1095C are due to employees by and a copy of each Form 1095C is due to the IRS by if filed electronically The final Form and instructions may be found on the IRS website The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Payroll 1095 C Information Affordable Care Act Aca

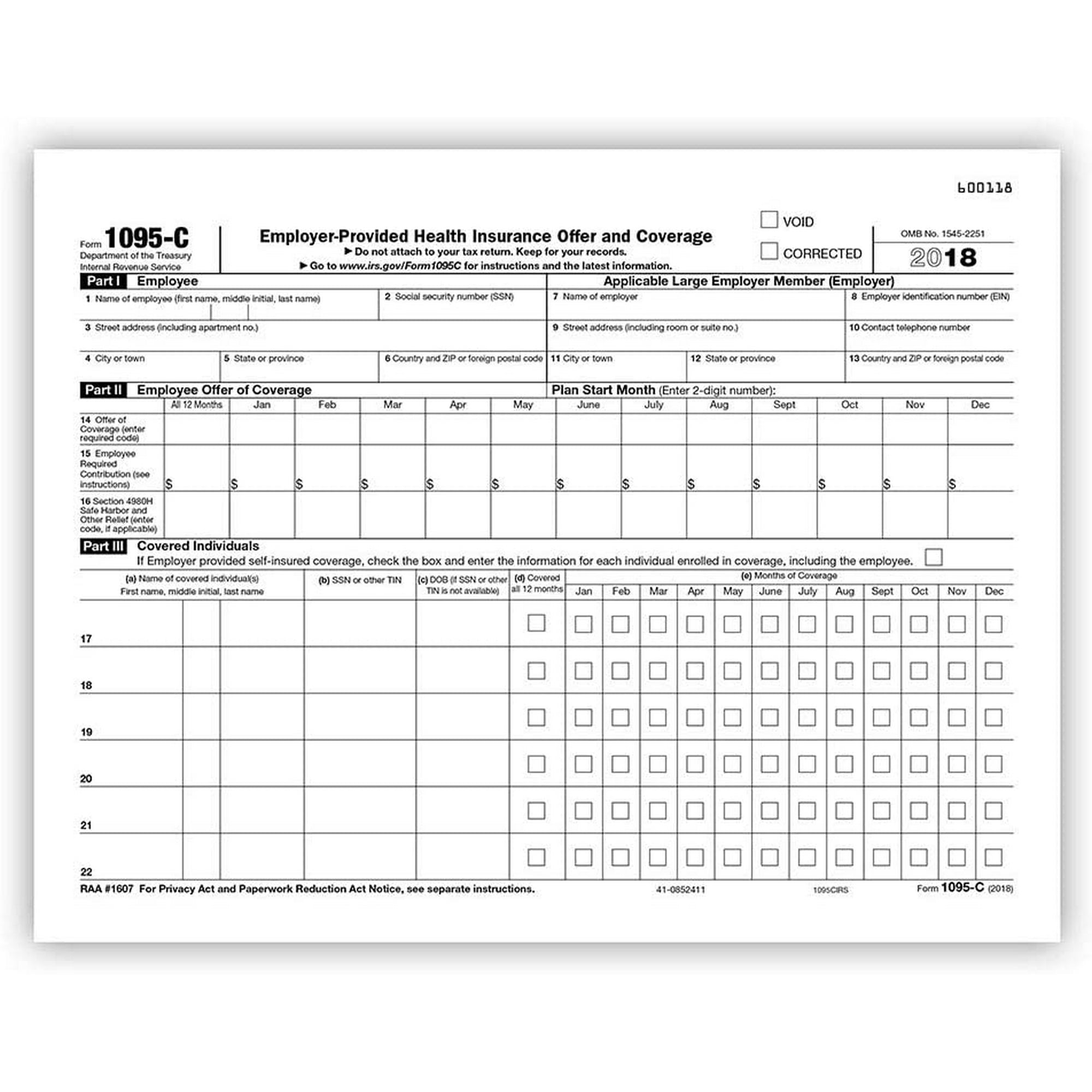

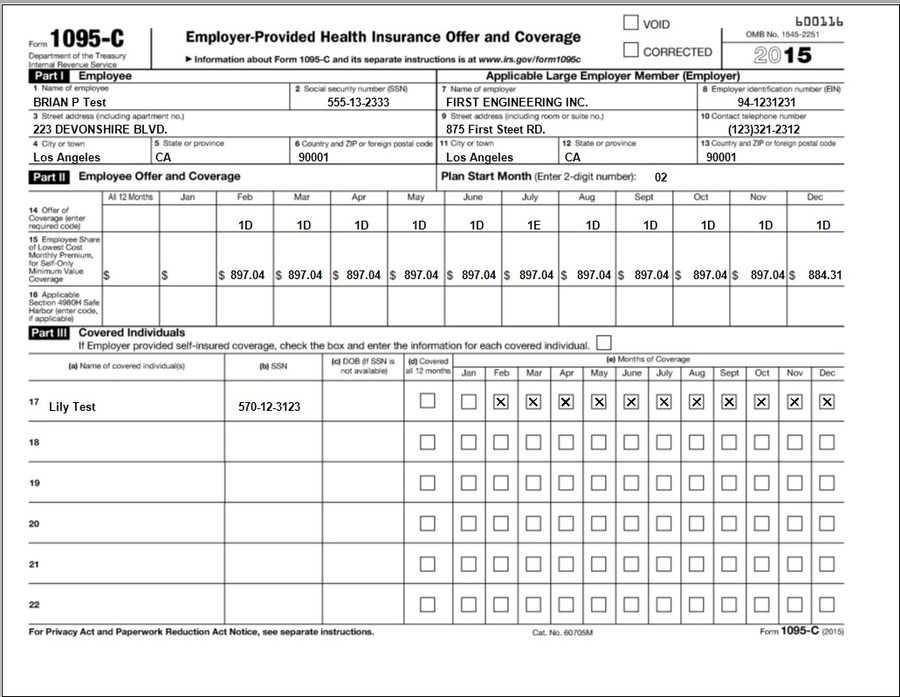

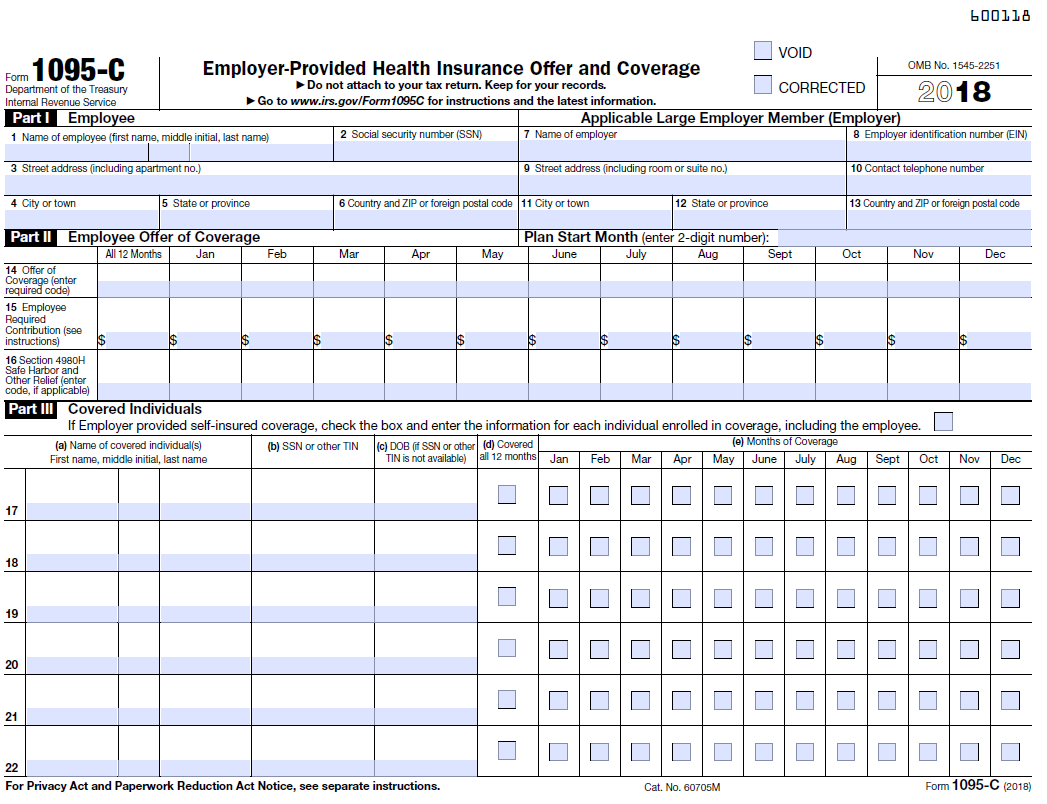

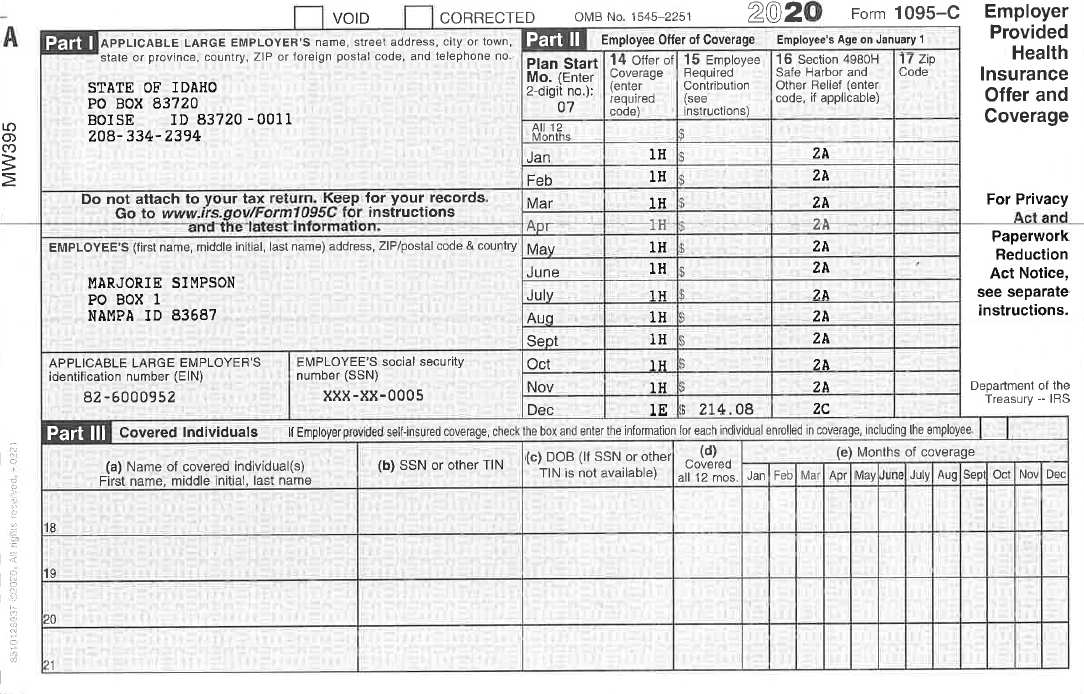

Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19 The instructions to the Forms 1094C and 1095C included language that asserted no penalty would be imposed under IRC sections 6721 or 6722 for incorrect or incomplete Forms 1095C so long as the employer showed that it made goodfaith efforts to comply with the information reporting requirementsWhich months during the year the employee was eligible for coverage

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Find us at https//wwwbernieportalcom/hrpartyofone/In , the IRS issued a few key updates to Form 1095C Now, all applicable large employers (ALEs)2 Understanding ACA Form 1095C Line 14 and 16 Codes One of the essential aspects of Form 1095C is understanding how to communicate information regarding employees' coverage To do this, Employers will need to use Code Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review theReporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formatting modifications, there are no significant changes from the 17 forms and instructions As a reminder, the A A individual mandate penalty for 18

1095 C Preprinted Portrait Version With Instructions On Back

What Your Clients Need To Know About Form 1095 C Accountingweb

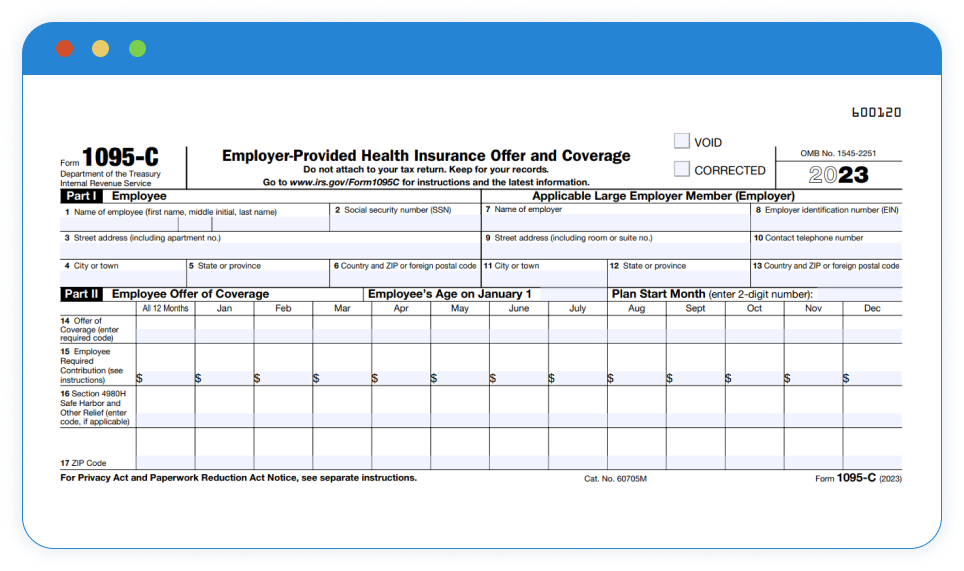

Specific Instructions for Form 1095C Part I—Employee Line 1 Return to top Enter the name of the employee (first name, middle initial, last name) Line 2 Return to top Enter the 9digit SSN of the employee including the dashes Lines 3–6 Return to top Enter the employee's complete address (including apartment no, if applicable)Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;The draft 19 instructions for both the 1095B and 1095C remain the same as the 18 instructions, except for two numerical changes (i) increasing the maximum penalty for failing to file correct information returns or furnish correct payee statements to $3,339,000 (from $3,275,500 in 18), and updating examples with the correct year;

1095 C 17 Public Documents 1099 Pro Wiki

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

In the Process Payroll Tax Forms screen, select 1095C from the Form type dropdown list In the Year dropdown list, select the year for the 1094C and 1095C forms you want to process and then click the Refresh button Use the Filter Options section to limit the clients and forms that display in the Form Selection gridIn midNovember, the IRS has released draft instructions for the 19 tax year 1094/1095B and 1094/1095C forms "While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA employer mandate reporting Form 1095C Instructions 21 Form 1095C, Employer EmployerProvided Health Insurance Offer and Coverage is the tax form filed by employers reporting the employersponsored health coverage Applicable Large Employers are mandated to offer health coverage to their employees and Form 1095C is the tax form that reports the coverage offered

B95cperfi05 2up Blank 1095 C Full Page With Instructions Greatland Com

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Will it come with my W2?See the Instructions for Form 1095A Form 1095A information is entered on screen 95A This information carries to Form 62 , unless the income is below the Poverty Level When you view the return you will not see a 1095A form, only the 62 No form 1095A is produced in view mode See Screen 95A for a data entry demonstrationForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C also is used in determining the eligibility of employees for the premium tax credit

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

With so many changes with the new Affordable Care Act or ACA, we are just beginning to understand the bigger picture of it all Check out this video for morPopular Form 1095A Versions & Alternatives 1095C Form Form 1095C is a tax document that is used to verify coverage information to employers and other entities It is also used to assess a penalty if the individual is uncovered Form 1095C is a form for those who have purchased a Marketplace insurance plan 1 No Extensions on ACA Form 1095C Deadlines for 21 During this time last year, the IRS announced it was extending the deadline for distributing Form 1095C to individuals from January 31st to March 02, in notice 76 In 21, the ACA reporting deadlines seem to

1095 C Form Final

Vehi Org

Are There Specific Form 1095C Instructions for Filing for Employers?Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 21 Form 1095B How to File 1095Cs with the IRS Forms 1094C and 1095C may be filed through the mail or electronically (efile) All Applicable Large Employers (ALEs) reporting on 250 employees however are required to efile Though not always required, the IRS highly encourages employers to file electronically even if they have less than 250 employees

Employer Aca Reporting Final Forms Lawley Insurance

Online Delivery Of W 2 Statement And Form 1095 C

Employers must furnish Form 1095C to employees by The IRS extended this due date for 16 and the deadline will be January 31 (same as W2) in the futureForm 1095C Part II Filing Guide Answer the questions below to help you better understand what codes to enter in Lines 1417 of Form 1095C Please note that this information covers common scenarios and is not allinclusive IMPORTANT UPDATE As of , the IRS has added two new line 14 codes that are not reflected in this tool 1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)

1095 C Sample Hcm 401 K Human Resources

1095 C Print Mail s

18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements 1094C/1095C Deadlines Form 1095C must be sent out to employees by When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14Form 1095C instructions and general guidelines Here is an overview of the 1095C form IRS that explains what it is, which information the statement contains, and who should file it IRS Form 1095C is a mandatory annual health insurance statement issued by certain employers, namely applicable large employers (ALEs), to their fulltime employees

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

Co Form Dr 1094

Form 1095C & Instructions The changes to the Form 1095Citself are minor so I will not add further confusion by discussing them The draft Instructions, however, are another story InflationAdjusted Affordability Figure The Instructions now clarify that the 95% affordability figure is inflationadjusted As a reminder, the figure is 966% for plans beginning in 16 and 969% for Form 1095C Line by Line Instructions Updated on 1030 am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year 21, form 1095C has been updated The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage,

Sample 1095 C Forms Aca Track Support

Form 1095 C Forms Human Resources Vanderbilt University

To determine what code to enter for line 16, review each of the options below and select the one (s) that best fit the situation Line 16 Codes, as defined by the IRS 1095C instructions 2A Employee was not employed during the month 2B Employee is not a fulltime employee 2C Employee enrolled in the coverage offered All Form 1095C Revisions And here are some 1095C pointers Use the 1094C form to tell the IRS about whether you offered workers Minimum Essential Coverage (MEC) You may see the term ALE used in the 1094 and 1095 instructions This means Applicable Large Employer As in an employer who must file the formsEmployers may file Form 1095C by paper or electronically ALEs filing 250 or more Forms 1095C are required to file electronically Important Form 1095C Instructions Information on Form 1095C is arranged by three rows of coded information

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

The follow guide provides an insight on how you can complete the IRS form 1095C using the PDFelement program Step 1 Go to the Internal Revenue Service Website and download a copy of the IRS Form 1095C with the filling instructions Open it with PDFelement and start filling it out using the program Step 2 Begin filling Part IEmployeeForm 1094C and Form 1095C (and related instructions) will be used by applicable large employers (ALEs) to report under Section 6056, as well as for combined Section 6055 and 6056 reporting by ALEs who sponsor selfinsured plans These forms and instructions include a number of changes and clarifications related to reporting The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are Applicable

Irs Gov

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Irs Gov

Irs Releases Final Reporting Forms The Aca Times

Form 1095 C For Self Funded Plans

1094 C 1095 C Software 599 1095 C Software

Free 1095 C Resource Employee Faqs Yarber Creative

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 A 1095 B And 1095 C Blank Lies On Empty Calendar Page Editorial Photo Image Of Paper Form

Form 1095 C Printable Get 1095c Form To Print Healthcare Marketplace Tax Form Fillable With Instructions

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Sample 1095 C Forms Aca Track Support

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Form 1095 C H R Block

Irs Form 1095 C Fauquier County Va

Aca Forms And Reporting Instructions The Aca Times

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

trix Irs Forms 1095 C

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 Walmart Canada

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Form 1095 C Guide For Employees Contact Us

Accurate 1095 C Forms Reporting A Primer Integrity Data

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Form 1095 C Instructions Office Of The Comptroller

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Newest Ez1095 Aca Software Is Easy And Fast With Latest Import Feature In The 19 Version

Changes Coming For 1095 C Form Tango Health Tango Health

1

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Irs E Filing Deadline March 31 22 Aca Gps

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

1095 C Template Fill Online Printable Fillable Blank Pdffiller

1095 C 18 Public Documents 1099 Pro Wiki

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

Preprinted 1095 C Full Page Form W Instructions B95cfprec05

1095 C Employer Provided Health Insurance Offer Of Coverage

Sample Print Of 1095 B And 1095 C 1095 Software

1095 C Form 21 22 Finance Zrivo

Affordable Care Act Electronic Filing Instructions

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Form 1095 A 1095 B 1095 C And Instructions

Sample 1095 C Forms Aca Track Support

Ins Employee 1095 C Report

Vehi Org

What Is An Irs Form 1095 C Boomtax

Irs Gov

Instructions For Forms 1095 C Taxbandits Youtube

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Changes Coming For 1095 C Form Tango Health Tango Health

1094 C Form Transmittal Zbp Forms

Irs Gov

Filled Out 1095 C

1

Form 1095 A 1095 B 1095 C And Instructions

1095 Software Ez1095 Affordable Care Act Aca Form Software

Vehi Org

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1095 C Instructions Office Of The Comptroller

1095 C Form 21 22 Irs Forms

1095 C Blank Form With Fold Perf And Instructions

Changes Coming For 1095 C Form Tango Health Tango Health

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

What Payroll Information Prints On Form 1095 C To Employees

Affordable Care Act Forms 1095 C Kit 50 Or 100 Pack Hrdirect

Irs Form 1095 C Codes Explained Integrity Data

Irs Gov

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

1095 Software Ez1095 Affordable Care Act Aca Form Software

Form 1095 C Pre Printed Official Irs Form Includes Instructions On The Back

Ps95cisb Blank Pressure Seal 1095 C Ez Fold Form With Instructions Brokerforms Com

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1

0 件のコメント:

コメントを投稿